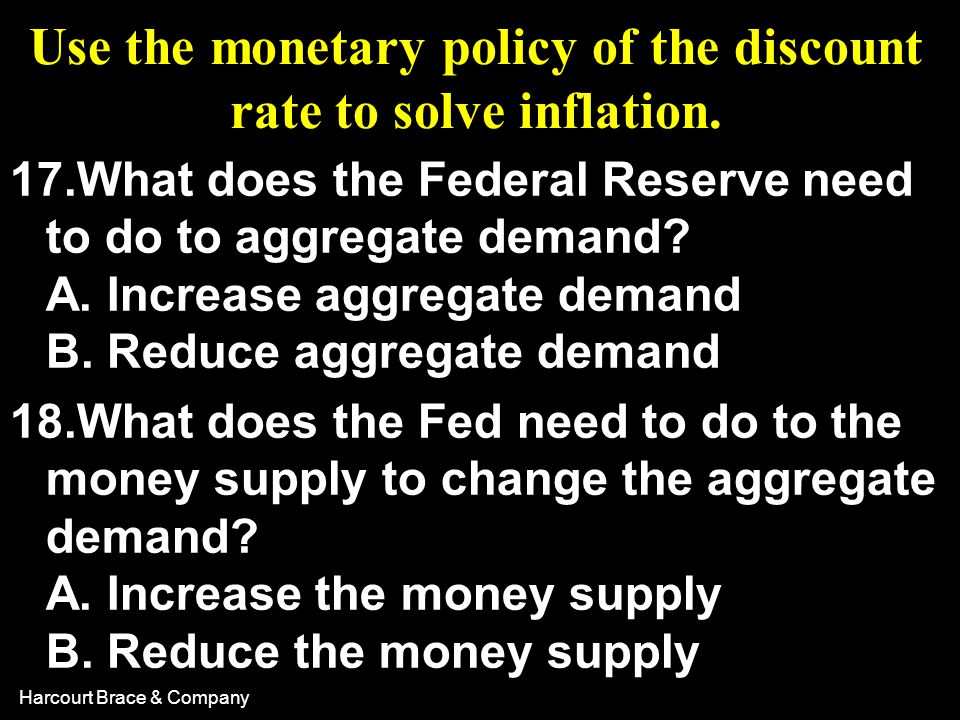

The Federal Reserve Can Increase Aggregate Demand By | Explaining the different components which affect ad. Aggregate demand usually increases alongside the increase in household wealth and vice versa. It is often called effective demand, though at other times this term is distinguished. (a) an increase in consumer confidence or business for example, as discussed in the monetary policy and bank regulation chapter, the federal reserve can affect interest rates and the availability of credit. The federal reserve can increase aggregate demand by multiple choice raising the reserve requirement reducing the discount rate reducing the money supply selling government securities in the open market.

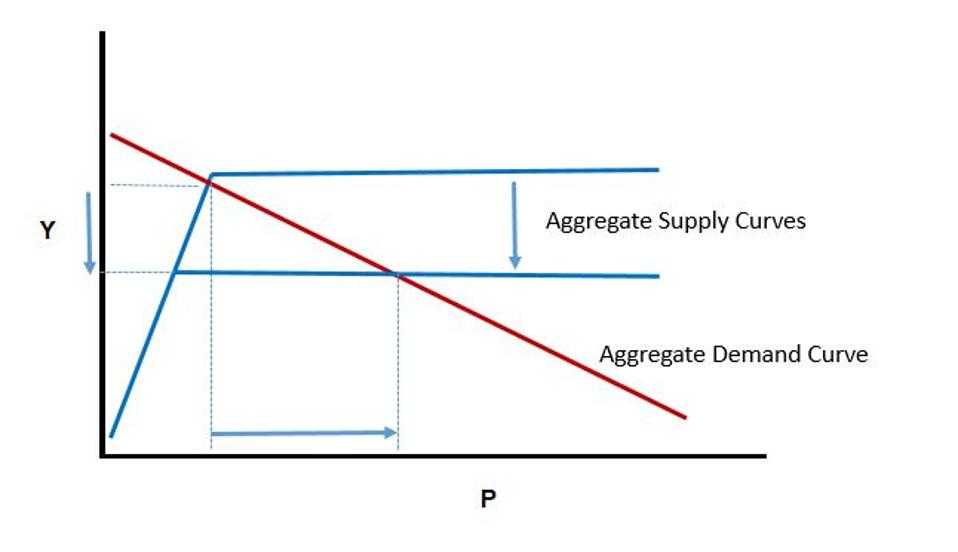

When aggregate supply is less than aggregate demand how can we expect increase in the real gdp. Aggregate demand quizzes about important details and events in every section of the book. There are many actions that will cause the aggregate demand curve to shift. Aggregate demand (ad) is the total demand for final goods and services in the economy at a given time and price level. Easytopic which set of events would most likely increase aggregate demand a an increase.

To stabilize interest rates, the federal reserve will respond to an increase in money demand by. We're being given that the federal reserve expands the money supply by 5% and party winning to use the theory of liquidity preference to illustrate in a graph the impact of this policy on we showed that while output initially rises because of the increase in aggregate demand over time, we were full ones. Decreases and aggregate demand shifts left. Therefore this is an increase in ad (an injection into the circular. In macroeconomics, aggregate demand (ad) or domestic final demand (dfd) is the total demand for final goods and services in an economy at a given time. All these groups are spending more on goods and. There are many actions that will cause the aggregate demand curve to shift. Goods leave the country but money from abroad flows into the economy. Suppose that the federal reserve is concerned about the effects of falling stock prices on. The money supply to increase. Aggregate demand refers to the sum total of expenditure that the people plan to incur on the purchase of goods and services produced in an economy corresponding to their different levels of income. B) federal reserve policy to expand the money supply. In the aggregate expenditures model, a change in autonomous aggregate expenditures changes equilibrium real gdp by the multiplier an increase in autonomous aggregate expenditures shifts the aggregate demand curve to the right;

Easytopic which set of events would most likely increase aggregate demand a an increase. When it lowers interest rates, asset prices climb. The federal reserve can increase aggregate demand by multiple choice raising the reserve requirement reducing the discount rate reducing the money supply selling government securities in the open market. This is made by households, and sometimes consumption accounts for the larger portion of aggregate demand. To stabilize interest rates, the federal reserve will respond to an increase in money demand by.

In the aggregate expenditures model, a change in autonomous aggregate expenditures changes equilibrium real gdp by the multiplier an increase in autonomous aggregate expenditures shifts the aggregate demand curve to the right; (a) an increase in consumer confidence or business for example, as discussed in the monetary policy and bank regulation chapter, the federal reserve can affect interest rates and the availability of credit. Buying government bonds, which increases the supply of money. Transcribed image text from this question. There are a number of ways that investment can fall. All these groups are spending more on goods and. The federal reserve can increase aggregate demand by multiple choice raising the reserve requirement reducing the discount rate reducing the money supply selling government securities in the open market. A reduction shifts it to the left. It is a macroeconomic term that describes the relationship between all the things which are bought within the country with their prices. The aggregate demand/aggregate supply model. Following changes in aggregate demand is crucial to understanding fluctuations in economic cycles. Higher asset prices for assets such as homes and stocks boost confidence among. To stabilize interest rates, the federal reserve will respond to an increase in money demand by.

Aggregate demand (ad) is the total demand for final goods and services in a given economy at a given time and price level. The aggregate demand/aggregate supply model. A reduction shifts it to the left. Transcribed image text from this question. Aggregate demand usually increases alongside the increase in household wealth and vice versa.

It can be increased when the credit creation capacity of the commercial banks gets increased. The federal reserve's direct effect on aggregate demand is mild, although the fed can increase aggregate demand in indirect ways by lowering interest rates. Aggregate demand is the overall total demand for all the goods and the services in the country's economy. When the federal reserve wishes to stimulate the economy, it lowers the reserve ratio. To stabilize interest rates, the federal reserve will respond to an increase in money demand by. Suppose that the federal reserve is concerned about the effects of falling stock prices on. Easytopic which set of events would most likely increase aggregate demand a an increase. Transcribed image text from this question. But an increase in savings can actually have the opposite effect. When it lowers interest rates, asset prices climb. All these groups are spending more on goods and. It is a macroeconomic term that describes the relationship between all the things which are bought within the country with their prices. The federal reserve can attempt to increase overall spending (aka aggregate demand) by lowering interest rates.

The Federal Reserve Can Increase Aggregate Demand By: Buying government bonds, which increases the supply of money.

Source: The Federal Reserve Can Increase Aggregate Demand By